Cagamas Annual Report

2024

Download Report

Download Financial Statements

Group Financial Highlights

RM

2.4

BILLION

Total Revenue

2023: rm2.3 billion

RM

477.7

MILLION

Profit Before Taxation

2023: RM447.8 Million

RM

364.2

MILLION

Net Profit for the Year

2023: rm330.1 Million

RM

242.8

SEN

Basic Earnings Per Share (Sen)

2023: rm220.1 sen

RM

54.1

BILLION

Total Assets

2023: rm57.8 billion

RM

7.5

BILLION

Total Equity

2023: rm7.1 billion

Key Highlights in 2024

Liquidity Provision and Securitisation

Facilitated FI’s liquidity through the purchase of RM13.0 billion under the PWR scheme

Residential mortgages continued to dominate Cagamas’ portfolio at 95.8% of the net outstanding loans and financing

Provided further capital support to FIs with RM2.3 billion of Capital Management Solutions as of 31 December 2024

Mortgage Guarantee Programme

Rolled out a new scheme, First Home Mortgage Guarantee Programme (FHMGP), under the Mortgage Guarantee Programme

Successfully onboarded eight (8) participating banks since the FHMGP launch in June 2024

28 applications approved under FHMGP scheme, with a total financing value of RM11.2 million

Reverse Mortgage Programme

Expanded market reach for SSB and SSB-i programmes through engagements and strategic partnerships

55 loans cumulatively approved for senior home owners for SSB and SSB-i

Approval rate remained higher than 50% for SSB and SSB-i applications

Issuance and Fund

Raising

Top 3 corporate bond issuer in the conventional bond market for 5 years in a row since 2020

Entered into RM50 million 3-month Social Repurchase Agreement (“Social Repo”) with a local financial institution

Issued RM145 million each for Cagamas’ first 3-month and 6-month Islamic Commercial Papers (“ICPs”) with ASEAN Social SRI Sukuk status

CEO Insights: Year in Review 2024

Message from the Chairman

Dear Shareholders,

In 2024, the Cagamas Group of Companies (“the Group”) successfully navigated a dynamic economic landscape shaped by global monetary policy adjustments, inflationary pressures, and geopolitical uncertainties. The Group remained focused on ensuring stability in its financial performance, supporting market liquidity, and advancing our role as a key enabler of sustainable home financing.

Dato’ Bakarudin Ishak

Chairman

What We Do

Purchase with Recourse (PWR)

- 11.7% of net operating income

- 69.3% of total assets

Purchase without Recourse (PWOR)

- 35.3% of net operating income

- 12.8% of total assets

Capital Management Solutions (CMS)

- 1.8% of net operating income

- 4.2% of total assets

Liquidity Provision and Securitisation

Investment

- 45.8% of net operating income

- 13.5% of total assets

Issuance and Fund Raising

- 96.3% of total liabilities

Treasury and Fund Raising

Mortgage Guarantee Programme (MGP)

- 6.9% of net operating income

- 0.7% of total liabilities

Mortgage Guarantee Programme

Reverse Mortgage (RM) Programme

- 0.04% of net operating income

- 0.01% of total assets

Reverse Mortgage Programme

Our Business Imperatives

Financial Capital

To encourage home ownership through liquidity provision to financial institutions, our business and operations are supported by:

- Shareholders’ fund of RM7.5 billion and robust capital with Group Total Capital Ratio of 50.5%.

- Credit strength with global rating of A3 by Moody’s and local ratings of AAA by RAM Ratings and MARC Ratings, enabling access to competitively priced funding resources.

Human Capital

Our 112 employees are the heartbeat of our organisation. We prioritise their growth by investing in learning, development and providing a positive environment to drive them towards a culture of excellence, encapsulated by our Core Values, C.A.R.E. (Collaboration, Accountability, Resilience and Excellence).

Social & Relationship Capital

Continuously strengthen relationships with stakeholders to fulfil our mandates and empower communities to build long-term positive societal impact through the following:

- Contributing RM1.7 million towards community engagement initiatives.

- Broadening access to housing finance solutions through our inclusive mortgage guarantee, liquidity provision and reverse mortgage programmes.

- Strategic engagements with policymakers, regulators and global secondary mortgage market association members.

Natural Capital

Cagamas Sustainability Strategy as a guidance for our transition to net-zero:

- Green and Affordable Home Financing initiatives including issuance of green bonds and sukuk to finance purchase of green homes loans and financing.

- Energy efficient initiatives to reduce environmental footprint and greenhouse gas (GHG) emissions net zero transition plan.

Intellectual Capital

Our intellectual capital are our values, principles and standards that drives our behaviour and linked to our branding and credibility. These are built on:

- Developed risk management practices to attain optimum returns whilst operating within a sound business environment.

- Digital strategy to modernise infrastructure, digitalise product journey, enhance cybersecurity and achieve cost-efficiency to ensure long-term business sustainability.

What We Do

Liquidity Provision and Securitisation

Mortgage Guarantee Programme

Reverse Mortgage Programme

Treasury and Fund Raising

Our Sustainability Pillars

Promote Sustainable Home Ownership

Employer of Choice

Positive Societal Impact

Positive Environmental Impact

RM

46.7

BILLION

Total Financing Assets

(-9.6% YoY*)

RM

45.0

BILLION

Total Funding

(-8.0% YoY*)

RM

54.1

BILLION

Total Assets

(-6.4% YoY*)

RM

46.7

BILLION

Total Liabilities

(-7.9% YoY*)

RM

545.2

MILLION

Net Operating Income

(+4.2% YoY*)

RM

364.2

MILLION

Net Profit

(+10.3% YOY*)

Customers

- Purchased home financing in the secondary market totalling RM12.0 billion in 2024, equivalent to a total of 37,212 homes.

- Continued to encourage first-time home ownership via First Home Mortgage Guarantee Programme (“FHMGP”) that was launched in June 2024, replacing the discontinued Skim Rumah Pertamaku (“SRP”).

- More than 100,000 individuals/ households benefited through FHMGP, SRP, Skim Perumahan Belia since 2011; of which 91.0% are from the B40 segment.

- Signed Memorandum of Understanding with financial institutions to increase customer’s access to the reverse mortgage and guarantee programmes.

Investors

- Continued to promote Cagamas as the preferred investment choice through non-deal Asian regional roadshows in Singapore and Hong Kong.

Employees

- Equipped employees with 4,375 hours spent on learning and development, an average of 37 hours per employee, with training cost of RM1.1 million.

- Knowledge exchange for employees to learn financial institutions’ best practices and benchmarking study domestically and regionally in Indonesia and Japan.

- Refurbishment of Cagamas’ office to revitalise the spaces that will become the collaboration and innovation hub for Cagamas’ staff.

Communities

- Mobilised over RM1.7 billion of Sustainable Finance including RM1,523 million for affordable housing and RM150 million for non-carbon emitting industrial hire purchase receivables related to Small Medium Enterprises.

- Impacted the lives of more than 30,000 recipients through Corporate Social Responsibility initiatives and zakat distribution.

- 46 scholars benefitted from the Cagamas Scholarship Programme since 2016.

Regulators & Government

- Adhered to best-in-class practices to safeguard our assets.

- Complied with regulations to mitigate systemic risk.

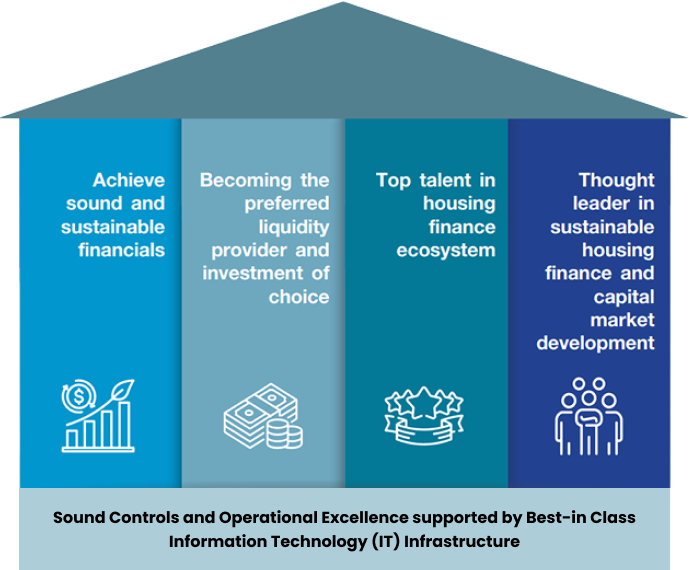

Continue To Be Guided By 5-Year Strategic Plan (2024-2028)

CAGAMAS HOUSE OF THE FUTURE

Our Aspiration

The preferred market liquidity provider and centre of excellence in the housing finance ecosystem

Sustainability Report

Pillar 1:

Promoting Sustainable Home

Ownership

FY 2024 Achievements and Progress

Cumulatively purchased home financing in the secondary market totalling RM226.3 billion, equivalent to 2.2 million homes, since inception in 1986.

Provided mortgage guarantees to more than 100,000 individuals/households to own their first house through First Home Mortgage Guarantee Programme (“FHMGP”), Skim Rumah Pertamaku (“SRP”) and Skim Perumahan Belia (“SPB”) since 2011; of which 91.0% are from the B40 segment.

Cumulatively issued a total of RM4.9 billion of sustainability bonds and sukuk since 2020 with RM2.9 billion outstanding as of 31 December 2024. The proceeds from the issuances have been primarily allocated to eligible assets in line with the Cagamas’ Sustainability Bond and Sukuk Framework, of which, 93.8% of the proceeds were channelled to affordable housing.

Pillar 2:

Employer of Choice

FY 2024 Achievements and Progress

4,375 hours spent on learning and development, an average of 37 hours per employee.

Identified potential successors who are “ready” currently stand at 62%, with RM1.1 million was invested in learning and development under various disciplines and programmes.

The Talents Behind Cagamas

Comprise of the following gender composition, age group and employment duration in Cagamas:

Expanded knowledge exchange by sending the employees to learn best practices from financial institutions and conducted a benchmark study with Cagamas’ counterparts in Indonesia and Japan.

Five (5) final-year students from universities all over Malaysia were selected for the Cagamas Internship Programme.

Refurbishment of Cagamas’ office to revitalise the spaces that will become the collaboration and innovation hub for Cagamas’ future.

Pillar 3:

Positive Societal Impact

FY 2024 Achievements and Progress

Impacted the lives of almost 30,000 recipients in 2024 through our Corporate Zakat Wakalah Programme (“ZWP”) and Corporate Social Responsibility (“CSR”) initiatives.

Contributed approximately RM1.5 million for Cagamas Scholarship Programme which benefitted 46 scholars since 2016.

Purchased RM150 million of non-carbon emitting industrial hire purchase receivables via Purchase with Recourse (“PWR”), benefitting 511 Small Medium Enterprises (“SMEs”).

Entered its inaugural Social Repurchase Agreement for SMEs & issued first Islamic Commercial Paper with ASEAN Social Sustainable and Responsible Investment (SRI) Sukuk label.

Pillar 4:

Positive Environmental Impact

FY 2024 Achievements and Progress

As part of Cagamas’ Net Zero Initiatives, Cagamas, in partnership with the Asian Development Bank (“ADB”) and Ernst & Young (EY) hosted a stakeholder consultation workshop to drive the development and promotion of Green Affordable Housing and Green Mortgages in Malaysia, especially among the B40, M40 and female-headed household.