Group Financial Highlights

View PDFRM 2,335.9MILLION

RM 447.8MILLION

RM 57,842.1MILLION

RM 7,148.7MILLION

220.1SEN

RM47.6

4.7%

0.6%

Key Highlights in 2023

View PDFLIQUIDITY PROVISION

Purchase with Recourse

RM20.5 billion

New record high for PWR annual purchase

Purchase without Recourse

RM51.8 million

First PWOR transaction since 2017 and the first with a financial institution

Capital Management Solutions

RM465 million

Subscription of subordinated debt issued by financial institutions

MORTGAGE GUARANTEE PROGRAMME

Cumulative amount of guarantee under SRP*

RM2,568 million

Cumulative number of loans and financing approved under SRP*

101,736

Percentage of borrowers from the B40 segment under SRP*

88.3%

*SRP refers to Skim Rumah Pertamaku, a scheme launched in March 2011 under Cagamas SRP Berhad. This scheme has been discontinued effective 1 April 2023.

REVERSE MORTGAGE PROGRAMME

Over 21 targeted roadshows & awareness programmes

34 Loans cumulatively approved for senior home owners

50%

Approval rate of the total application

ISSUANCE AND FUND RAISING

Total Fundraising

RM29.3 billion

Highest fundraising on record

Market Share

Ranked 1st

Most issued local corporate bonds and sukuk in 2023

Green Issuance

RM300 million

Inaugural issuance of ASEAN Green Bond and ASEAN Green SRI Sukuk

2023 Year in Review

Our Business Imperatives

View PDFTo encourage home ownership through liquidity provision to financial institutions, our business and operations are supported by:

- Shareholders’ fund of RM7.1 billion and robust capital with Group Total Capital Ratio of 53.8%

- Credit strength with global rating of A3 by Moody’s and local ratings of AAA by RAM Ratings and MARC Ratings, enabling access to competitvely priced funding sources

Our 101 employees are the heartbeat of our organisation. We prioritise their growth by investing in their learning and development and craft a positive environment to drive them towards a culture of excellence, encapsulated by our Core Values, C.A.R.E (Collaboration, Accountability, Resilience and Excellence)

Continuously strengthen relationships with stakeholders to fulfil our mandates and empower communities to build long-term positive societal impact via:

- Contribution of RM1.7 million towards community engagement initiatives

- Broadening access to housing finance solutions through our inclusive mortgage guarantee and reverse mortgage programmes

- Regular engagements with policymakers, regulators and strategic alliances at regional and global secondary mortgage market platforms

Partnering stakeholders transition to net-zero and encouraging the growth of green home loans and financing through issuance of green bonds and sukuk and establishment of Cagamas green homes framework

Our intellectual capital are our values, principles and standards that drives our behaviour and linked to our branding and credibility. These are built on:

- Developed risk management practices to attain optimum returns whilst operating within a sound business environment

- Digital strategy to modernise infrastructure, digitalise product journey, enhance cybersecurity and achieve cost-efficiency to ensure long-term business sustainability

WHAT WE DO

Liquidity Provision and Securitisation

Mortgage Guarantee Programme

Reverse Mortgage

Treasury and Fund Raising

OUR SUSTAINABILITY PILLARS

Promote Sustainable Home Ownership

Employer of Choice

Positive Societal Impact

Positive Environmental Impact

SUPPORTED BY OUR CORE VALUES

TOTAL FINANCING ASSETS

RM51.7 billion

(+18.9% YoY)

TOTAL FUNDING OUTSTANDING

RM48.9 billion

(+18.7% YoY)

TOTAL ASSETS

RM57.8 billion

(+15.8% YoY)

TOTAL LIABILITIES

RM50.7 billion

(+17.4% YoY)

NET OPERATING INCOME

RM532.1 million

(+3.0% YoY)

NET PROFIT

RM330.1 million

(-1.6% YoY)

- Purchased home financing in the secondary market totalling RM20.5 billion in 2023, equivalent to a total of 59,230 homes

- Further expansion of housing finance with mortgage market share at 5.4%

- Encouraged first-time home ownership via Skim Rumah Pertamaku (SRP) with total guarantee provided of RM289 million in 2023, benefitting 10,922 first-time home owners

- Continued to promote the Reverse Mortgage schemes (Skim Saraan Bercagar and Skim Saraan Bercagar Islamik) through 21 roadshows and awareness programmes

- Equipped employees with 2,081 hours spent on learning and development, an average of 24 hours per employee, with training cost of RM0.2 million

- Continued to promote Cagamas as the preferred investment choice through non-deal Asian regional roadshows in Singapore, Hong Kong, Japan and Korea

- Mobilised over RM1.2 billion of Sustainable Finance including RM825 million for affordable housing, RM300 million for green homes and RM100 million for non-carbon emitting industrial hire purchase receivables

- Impacted the lives of 18,523 recipients through Corporate Social Responsibility initiatives and Zakat distribution

- 41 scholars benefitted from the Cagamas Scholarship Programme since 2016

- Signed Memorandum of Understanding with Hong Kong Mortgage Corporation and Mortgage Refinancing Company of Uzbekistan for collaboration and exchange of knowledge in secondary mortgage industry

- Adhered to best-in-class practices to safeguard our assets

- Complied with regulations to mitigate systemic risk

FUTURE DIRECTION: 5-YEAR STRATEGIC PLAN (2024-2028)

CAGAMAS HOUSE OF THE FUTURE

OUR ASPIRATION

The preferred market liquidity provider and centre of excellence in the housing finance ecosystem

Sound Controls and Operational Excellence supported by Best-in Class Information Technology (IT) Infrastructure

Sustainability Report

View PDFPillar 1: Promote Sustainable Home Ownership

FY2023 Achievement and Progress

- Facilitating All Malaysians to Achieve Successful Home Ownership

Purchased home financing in the secondary market totalling RM20.5 billion, equivalent to a total of 59,230 homes

- Enabling Access to Home Financing for Low-to-Middle Income Groups

Provided mortgage guarantees to 110,339 individuals/households to own their first house through Skim Rumah Pertamaku (SRP) and Skim Perumahan Belia (SPB) since 2011; of which 87.0% are from the B40 segment

- Supporting the Growth of Affordable Homes through Sustainability Issuances

To date, Cagamas has cumulatively issued a total of RM3.7 billion of sustainability bonds and sukuk since 2020 with RM3.2 billion outstanding as of 31 December 2023

The proceeds from the issuances have been primarily allocated to eligible assets in line with the Cagamas’ Sustainability Bond and Sukuk Framework, of which, 85.8% of the proceeds were channelled to affordable housing

Pillar 2: Employer Of Choice

FY2023 Achievement and Progress

THE TALENTS BEHIND CAGAMAS

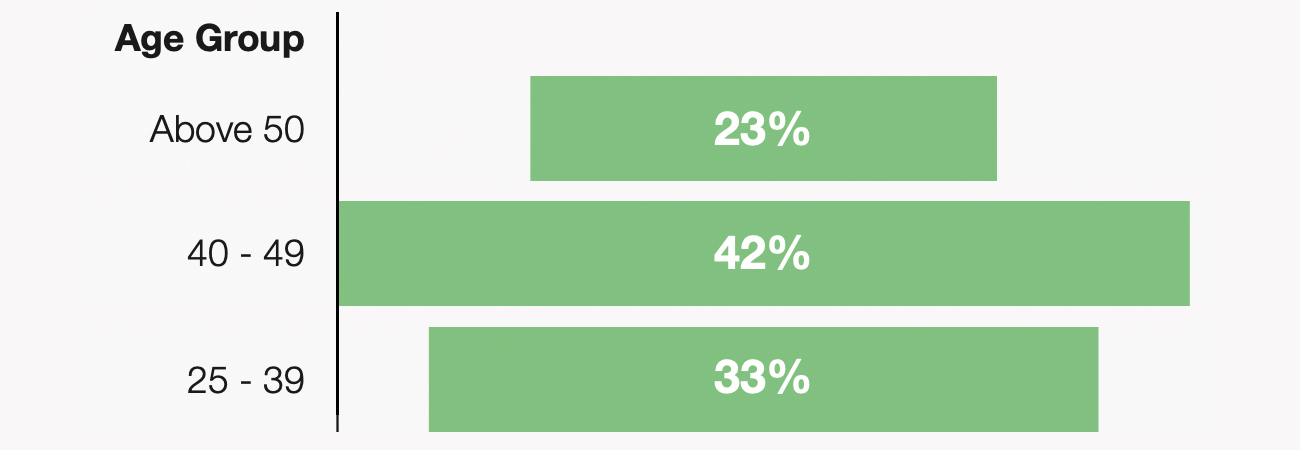

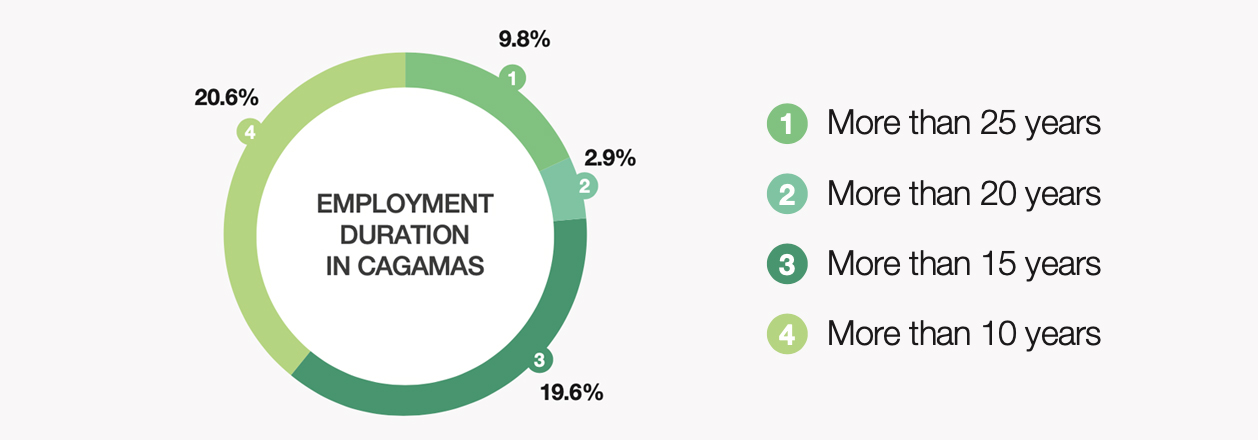

Comprise of the following gender composition, age group and employment duration in Cagamas:

-

2,081 hours spent on learning and development, an average of 24 hours per employee

-

Mission-critical successors who are “ready” currently stands at 56% and RM0.2 million training invested to increase readiness percentage

-

Six (6) final-year students from universities all over Malaysia were selected for the Cagamas Internship Programme

-

Encourage further work flexibility through weekly work from home arrangement and launched the inaugural annual Human Capital Month

Pillar 3: Positive Societal Impact

FY2023 Achievement and Progress

- Impacted the lives of 18,523 recipients in 2023 through our Corporate Zakat Wakalah Programme (ZWP) and Corporate Social Responsibility (CSR)

- Contributed approximately RM1 million to scholarships for 41 scholars since 2016

- Over 21 targeted roadshows and awareness programmes to promote the reverse mortgage scheme

- Purchased RM100 million of non-carbon emitting industrial hire purchase receivables, benefitting 502 Small Medium Enterprises (SMEs)

Pillar 4: Positive Environmental Impact

FY2023 Achievement and Progress

- Channelling Liquidity Towards Green Projects

Mobilised RM300 million towards green housing loans and financing, which marked our first-ever Green asset purchase via Purchase with Recourse (PWR)

- Kick-off Cagamas Net Zero Initiative

Admission to Joint Committee on Climate Change (JC3) Sub-Committee 3 (SC3) on Product & Innovation